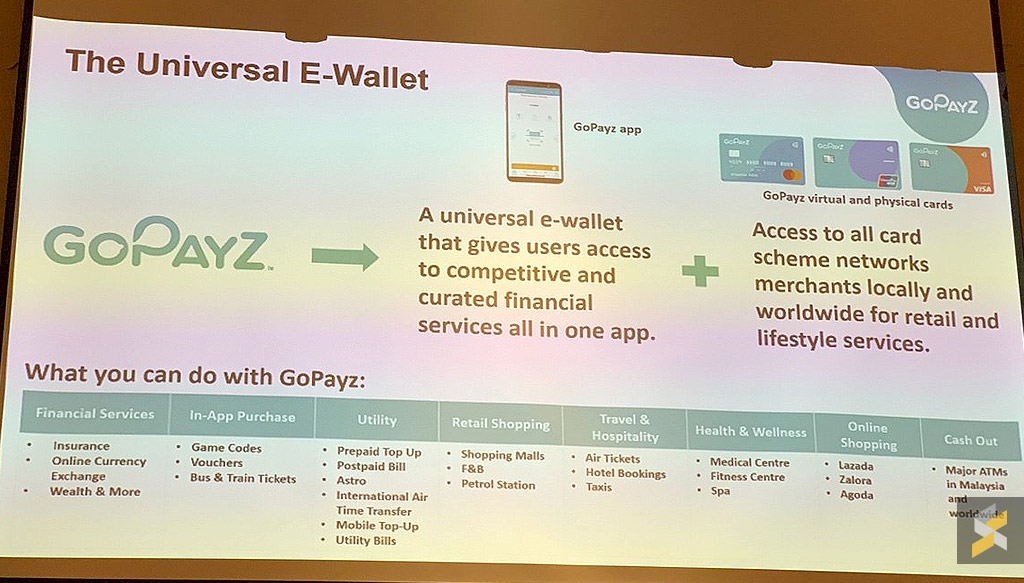

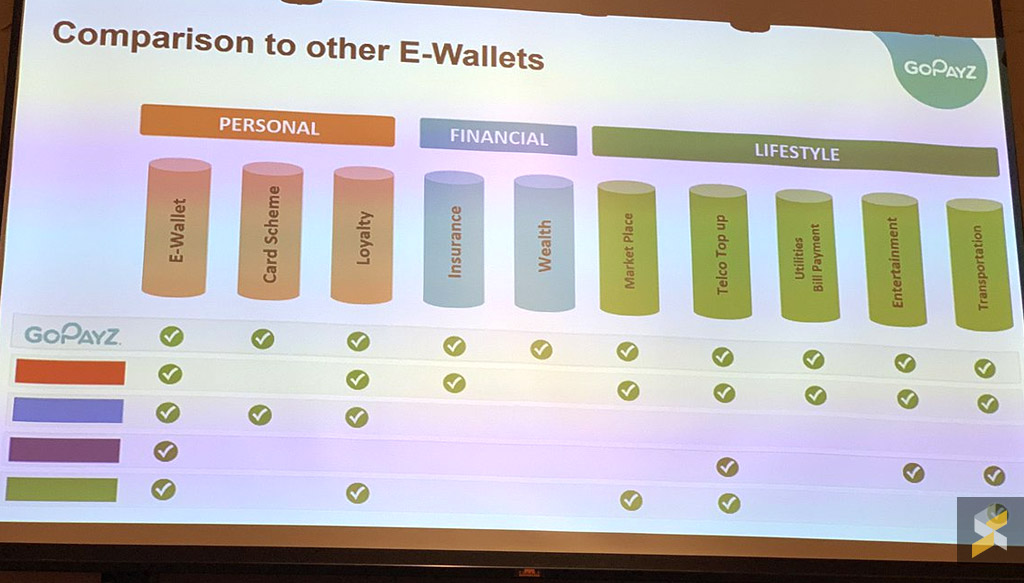

U Mobile has given a sneak preview of its new fintech ecosystem which will be rolled out in July 2019. GoPayz is a new kind of digital wallet which boasts wider acceptance worldwide and it aims to make financial services more accessible, affordable and inclusive.

GoPayz for Consumers

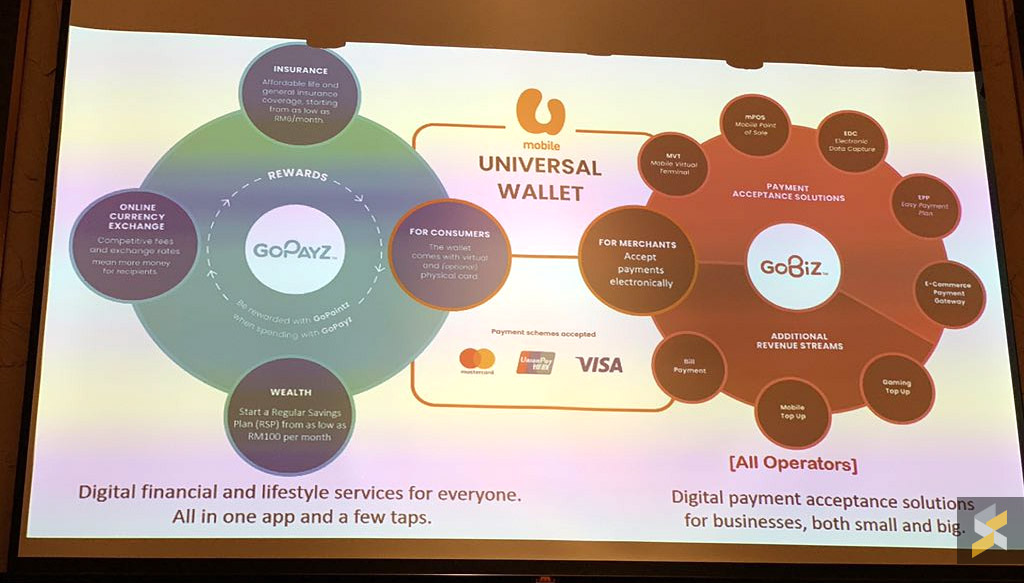

Unlike a typical eWallet that uses QR-code based payments, GoPayz is also accessible via virtual and physical cards. During the media briefing, it was revealed that users are able to request for physical Visa, Mastercard and UnionPay cards which can be used at card supported retail outlets worldwide. Similar to a normal debit card, users are also permitted to withdraw cash via ATMs. We are told that local withdrawals cost RM1 and it is RM10 for overseas.

The GoPayz has a maximum wallet size of RM5,000 and it can be topped up via online banking. Like most eWallet providers, GoPayz also rewards its users with GoPointz loyalty points which can be earned from various transactions and they also offer surprise rewards for qualifying transactions.

One of the key differentiation for GoPayz is its wide range of financial services that include insurance, online currency exchange and wealth products. They gave an example whereby users can sign up for micro-insurance products from GoLife Plus from as low as RM13/month. For currency exchange, users can request for exchange via the app and the foreign currency will be delivered to your doorstep.

GoPayz has security and fraud detection features in place which are compliant with Bank Negara Malaysia requirements. They added that all personal information and payment transactions are encrypted and protected 24/7.

GoBiz for Businesses

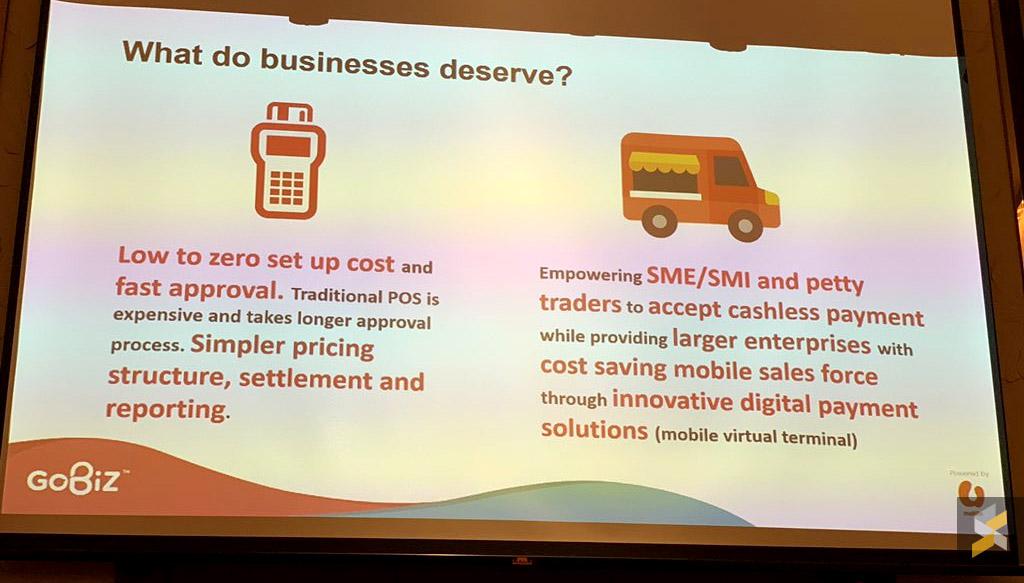

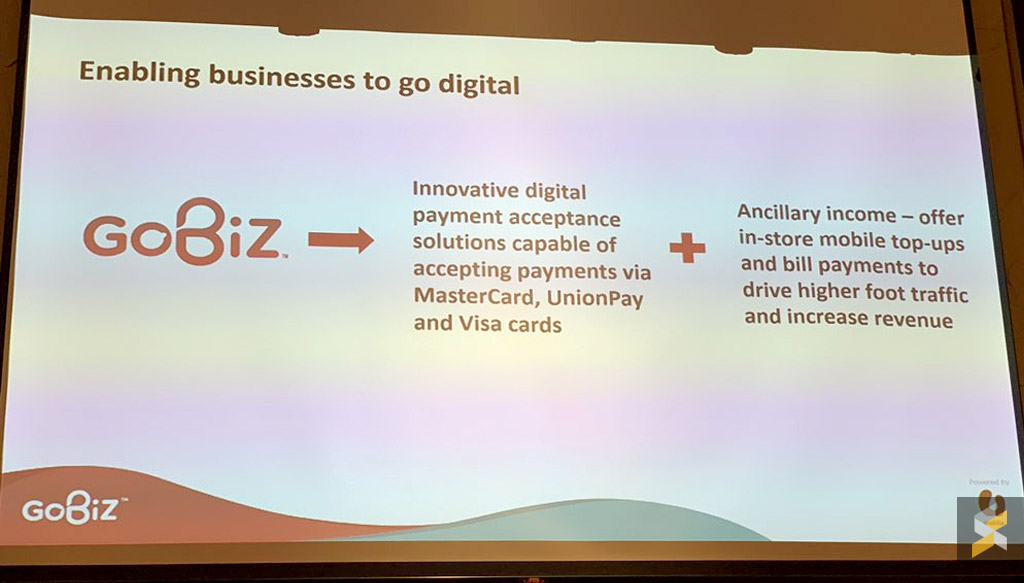

U Mobile also wants to enable small businesses to accept digital payments with GoBiz. The digital payment solution promises a low to zero cost to setup and it takes up to 3 working days for approval.

The digital payment solution is also capable of accepting MasterCard, UnionPay and Visa cards from both local and international customers. There’s also the option for merchants to earn additional income via mobile top-ups and bill payments. It was also revealed that GoBiz can also offer large merchants an integrated solution for Easy Pay Installment programs, eliminating the need of having separate card machines for every bank.

According to U Mobile CMO, Jasmine Lee, GoPayz is a significant milestone not just for U Mobile but for the fintech industry. She added that “U Mobile’s intention with our fintech ecosystem is to empower all, be it consumers and businesses. Hence, GoBiz seeks to enable all businesses, even the smallest of traders, to accept digital payments from customers and offer additional revenue-generating services like telco prepaid top-ups and bill payments for their customers.”

GoBiz will be accepting pre-registrations from interested merchants starting tomorrow via their website.