After introducing Apple Pay 4 years ago, Apple has just introduced their very own credit card that’s simply called Apple Card. Partnering with Goldman Sachs and Mastercard, the Apple Card is accepted worldwide even at merchants that don’t support Apple Pay.

Essentially, this is a physical credit card that’s managed entirely from the Apple Wallet app on the iPhone. In a way, this is similar to AirAsia’s BigPay card except that Apple offers a credit card instead of a prepaid card. The

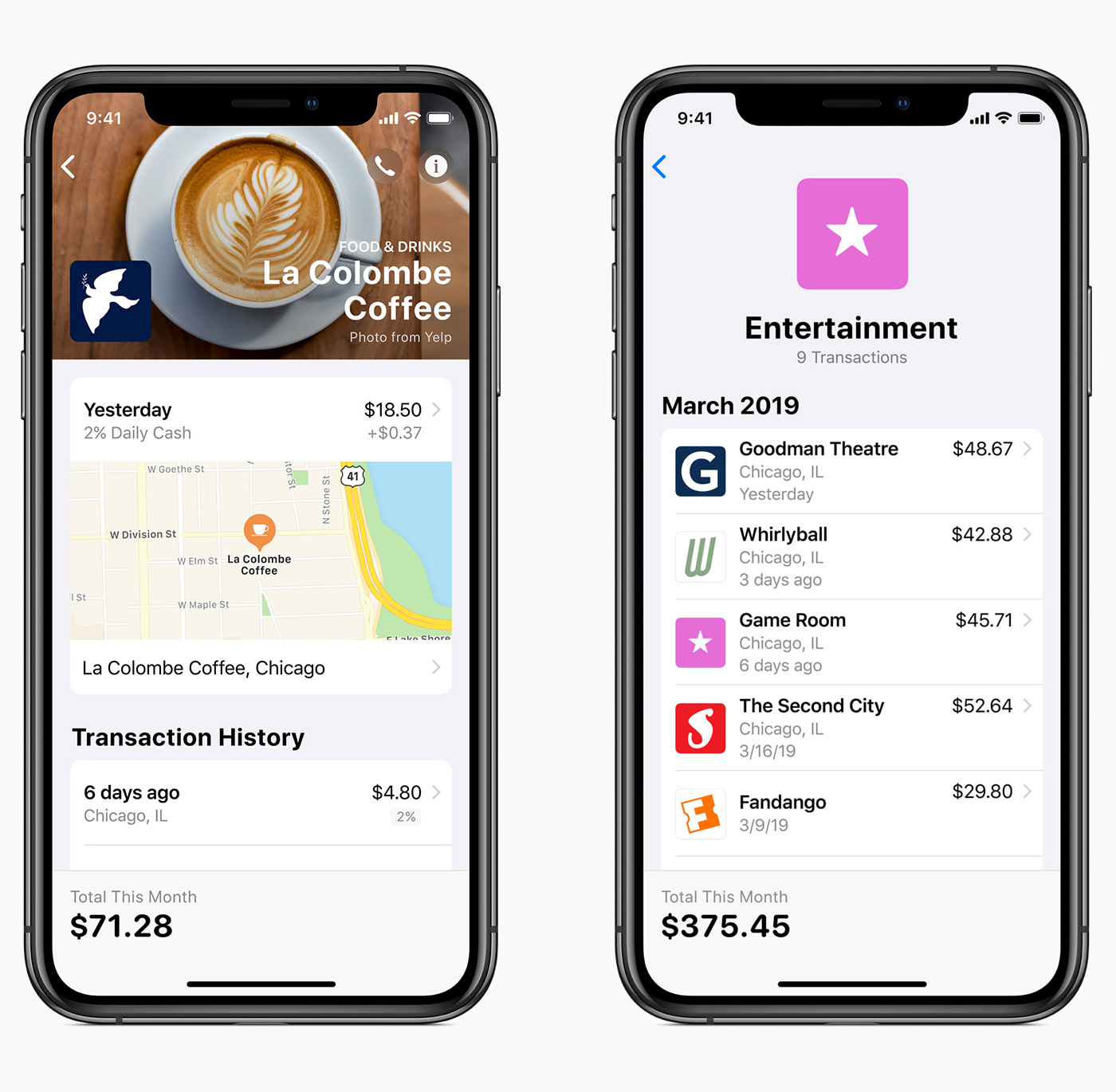

Whichever way you pay, you can track your expenses from your iPhone and get meaningful data including the name of the merchant, the transaction amount as well as the location of the outlet. To better track your expenses, your transactions are also listed according to categories.

With its interface, you can get a summary of how much you’ve spent, how much you owe and when your payment is due at a glance. Instead of getting credit card points, the Apple Card rewards you with Daily Cash. You can get 3% cash back on transactions made directly with Apple, 2% if the transaction is done by Apple Pay and 1% if it’s made with the physical titanium card.

The Daily Cash is given back to you each day which you can use it on your next transaction or transfer it to a friend or family via iMessage. To help you manage your finances better, the Apple Card interface will show a calculation of your interest charges based on how much you’re planning to pay. In a way, this encourages you to pay more each month so that you can pay less for interest.

What’s even more interesting is the titanium card itself. There’s no card number, CVV security code, expiry date or even a signature at the back. All it has is just your name, an Apple logo and an EMV chip at the front. If you need to use your card for online payments, there’s a virtual number that can be auto-filled when you’re using the Safari browser. It is worth noting that this is the first consumer credit card that’s issued by Goldman Sachs.

The Apple Card will be available in the US this summer which is just a couple of months away. When it comes to Apple Pay, Tim Cook also mentioned on stage that it will be available in more than 40 countries by the end of this year and the acceptance rate has been growing. In the US, 70% of businesses accept Apple Pay and it goes as high as 99% in Australia. Hopefully, Malaysia will be one of the 40 countries to get Apple Pay very soon.