Digi has just announced its new Happy Prepaid but it isn’t the same prepaid service that was launched 10 years ago. This time it’s a digital payment service in a form of a virtual Mastercard.

Essentially, this is a virtual prepaid card that is designed solely for online transactions. Since it is prepaid, you’ll have to reload the card first before performing your online transaction with the provided card details.

The virtual card can be a viable alternative for those who are paranoid about using their actual credit and debit cards online. You can use it for online subscriptions and shopping at e-commerce platforms worldwide as well as topping up your e-wallet.

According to Digi’s Chief Digital Officer, Praveen Rajan, a majority of e-commerce transactions still occur with cash and Digi wants to play their part in assisting people to go cashless, and more importantly, offer them the convenience to do what they want on their devices. The Digi Happy Prepaid Mastercard is managed by Y3llowLabs Sdn Bhd, a subsidiary of Digi Telecommunications in partnership with MPay and Mastercard.

To reward its users, the Happy card allows you to earn loyalty points when you use it for Grab and

It’s worth mentioning that this isn’t Digi’s first attempt at digital payments. The yellow telco had introduced VCash e-wallet more than a year ago. When it comes to virtual prepaid cards, AirAsia has done it before with EZPAY virtual card

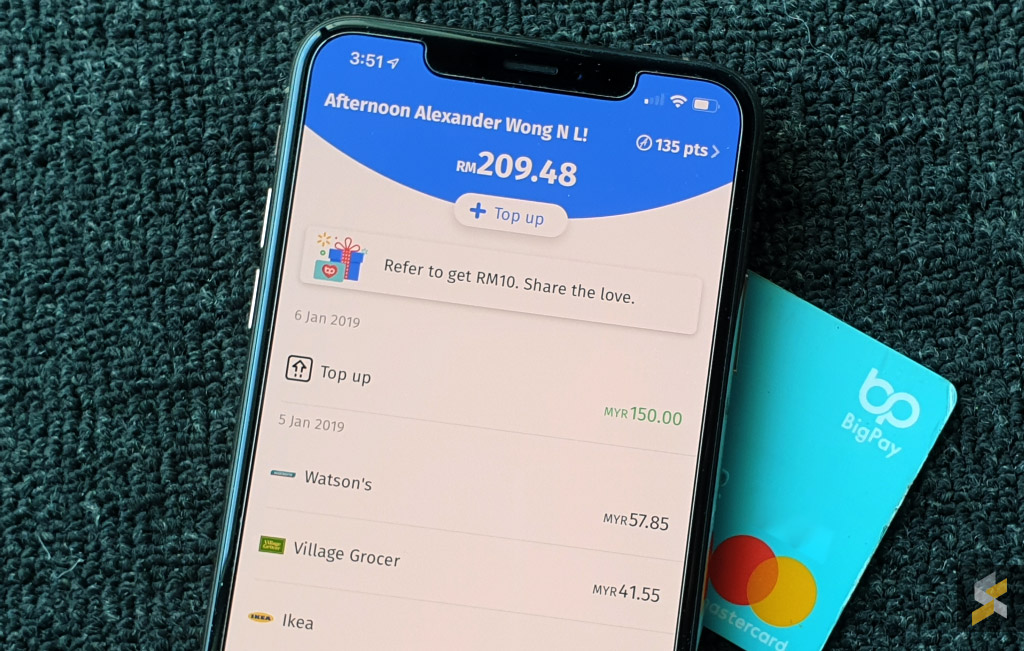

If we can sum it up, Happy prepaid looks like a “virtual” version of AirAsia’s BigPay card. For a quick refresher, BigPay is a prepaid MasterCard that comes with E-wallet-like features. You can use it to transfer funds by scanning QR codes of other BigPay users and you can view your expenses in real time with monthly

According to Digi’s Happy prepaid website, the app will push

If Digi wants to ride on a prepaid Mastercard, I think it would have made better sense if Digi offered a physical card with

At the moment, there are plenty of E-wallet providers in the market, and e-commerce platforms like Lazada and

What do you guys think of this virtual prepaid Mastercard? Is this something you would consider for online transactions? Let us know your thoughts in the comments below.