Apple had temporarily suspended trading today to deliver an announcement to its investors. It appears that fewer people are buying the iPhone than expected and as a result, Apple had to revise its earnings for its fiscal 2019 first quarter. Historically, Q1 is their best performing quarter in the whole year especially after introducing the latest iPhone models.

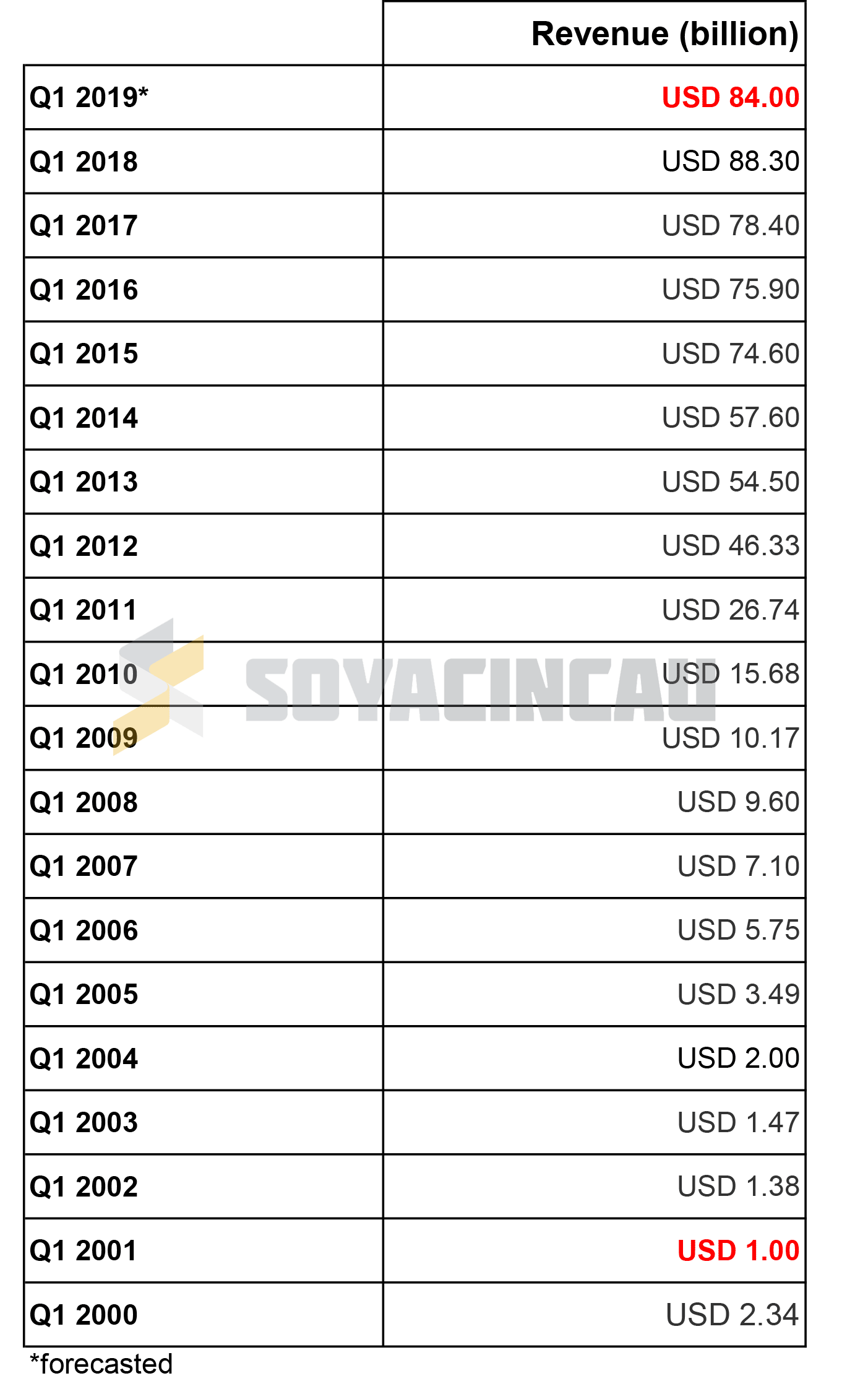

Apple had initially projected revenue of $93 billion for the Q1 this year but they are lowering its revenue guidance by 9.7% to $84 billion. For Q1 2018, Apple had posted record revenue of $88.3 billion and it was mostly driven by the iPhone X which had surpassed their expectations.

With this revision, this is expected to be the first Q1 revenue decline in 18 years. The last time they posted a decline in revenue for this period is in 2001 and that was before the iPod was introduced in October of the same year.

In his letter to investors, Tim Cook had mentioned several reasons for its slower iPhone demand. Firstly, it was the timing of the iPhone XS and XS Max release where both had gone on sale earlier compared to the iPhone X. He also cited the strengthening of the US dollar versus other currencies as well as supply constraints which affected sales of its latest Apple Watch, iPad Pro and MacBook Air.

EXCLUSIVE: After cutting Q1 expectations, Apple CEO Tim Cook tells CNBC that the shortfall is primarily in Greater China as trade tensions put pressure on the Chinese economy https://t.co/iOf79ebo17 pic.twitter.com/Lm7Wyp1VOX

— CNBC Now (@CNBCnow) January 2, 2019

What’s interesting is that China is attributed as the main source of year-on-year iPhone revenue decline while iPhone upgrades were not as strong as they hoped for in some developed markets. In his interview with CNBC, he also mentioned discounted battery replacements as one of the revenue decline factors.

Despite the revenue challenges in some emerging markets, Apple had reported new records in Mexico, Poland, Vietnam and Malaysia.

In terms of profitability and cash flow, Tim Cook mentions that they are expecting to end the quarter with $130 billion in net cash and they are planning to be net-cash neutral over time. The CEO also mentioned that Apple is expected to report a new all-time record for Apple’s earnings per share.

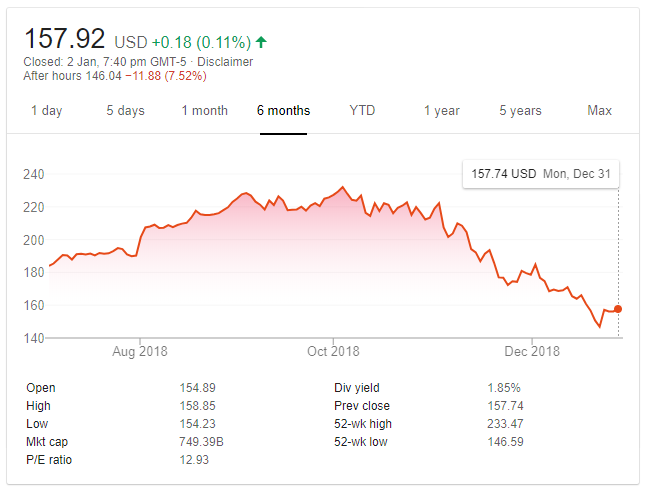

At the moment, Apple is trading at $157.92 which is a significant 32% drop from its record high of $233.47 in October 2018.

Related reading

[ SOURCE ]