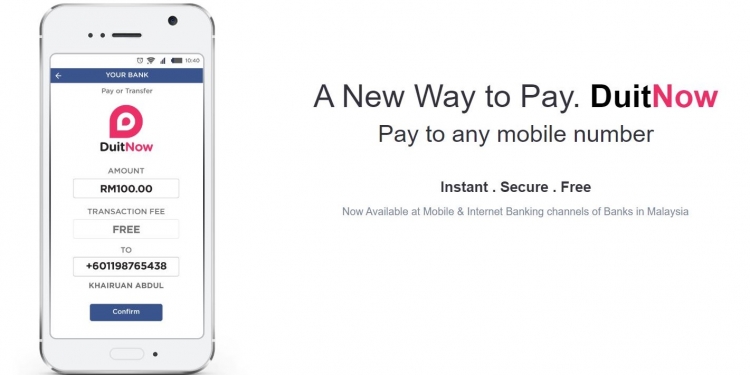

Starting from today, you don’t have to remember your recipient’s bank account number to transfer funds to that person. All you need to remember is the person’s mobile number. DuitNow, the service that lets you transfer funds to mobile numbers instead of bank account numbers, is now available for the public.

In addition to fund transfers using mobile numbers, DuitNow also enables fund transfers via MyKad, MyPR, Army, Police numbers, Passport and Business Registration numbers as well instead of using a bank account number that can be difficult to remember.

At launch, 14 banks support the service. An additional 17 financial institutions (banks and non-banks) will make DuitNow available for their customers soon.

The 14 banks that support the service right now are:

- Ambank (M) Berhad,

- Bank Islam Malaysia Berhad,

- Bank of China (Malaysia) Berhad,

- BNP Paribas Malaysia Berhad,

- CIMB Bank Berhad,

- Citibank Berhad,

- Hong Leong Bank Berhad,

- HSBC Bank Malaysia Berhad,

- Malayan Banking Berhad,

- OCBC Bank (Malaysia) Berhad,

- Public Bank Berhad,

- RHB Bank Berhad,

- Standard Chartered Bank Malaysia Berhad,

- United Overseas Bank (Malaysia) Berhad.

According to

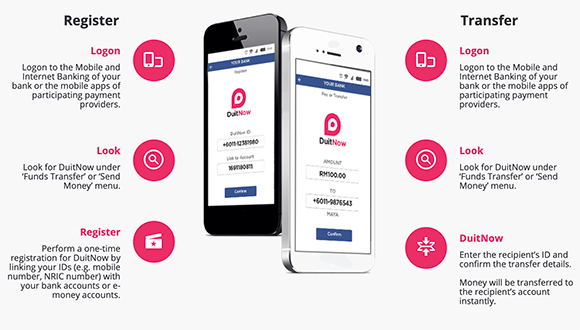

For those who would like to receive funds via DuitNow using their mobile number they will need to link their mobile number with their bank account number. You can do this online via the online banking portal of the banks that support the service currently. You can also link your MyKad or MyPR Identity Card numbers, Army or Police numbers, Passport numbers or Business Registration numbers to your bank account to receive fund using DuitNow.

In addition, those who have registered for the service can now view, modify or transfer their DuitNow registrations via the Internet or Mobile Banking channels from the 14 banks listed. This can be done from the online portals of any of the supporting banks. As far as we can tell, one mobile number can be linked to only one bank account at the moment. If you have multiple mobile numbers, it is possible to register for multiple DuitNow ID as long as it can be verified by your bank.

Fund transfers via DuitNow is done instantly in real time and it’s free of charge for transfers up to RM5,000. Customers can make transfer by accessing the DuitNow tab under the ‘Funds Transfer’ menu of their respective banks’ Internet or Mobile banking channels. A 50 sen fee may apply for transactions above RM5,000 but some banks may opt to not charge a fee even if you transfer more than RM5,000 at one time.

It’s worth pointing out that you only need to register for DuitNow to receive money. Those who are not registered are still able to send money to mobile numbers that are DuitNow-enabled. As an added verification, the registered account holder’s name will be displayed before you can complete the transaction. This is a safety net just in case you’ve keyed-in the wrong mobile number.

Apart from one-time transfers, DuitNow also supports scheduled and recurring transfers, and you can also add a DuitNow ID as your favourite recipient with your online banking facility.

DuitNow transfers are limited up to RM100,000 per day for consumers and up to RM100,000,000 per day for businesses. The actual transfer limit is also depended on your bank.

You can read more about DuitNow here.