When SST took effect starting 1 September 2018, many prepaid users in Malaysia were unhappy that their reloads carry less value due to the 6% tax deduction. A RM10 reload would only give you RM9.43 of credit.

Lim Guan Eng had mentioned that prepaid was excluded from SST and telcos should give RM10 value for RM10 of top up. However, telcos had started deducting taxes to comply with the Sales & Services Tax Act 2018.

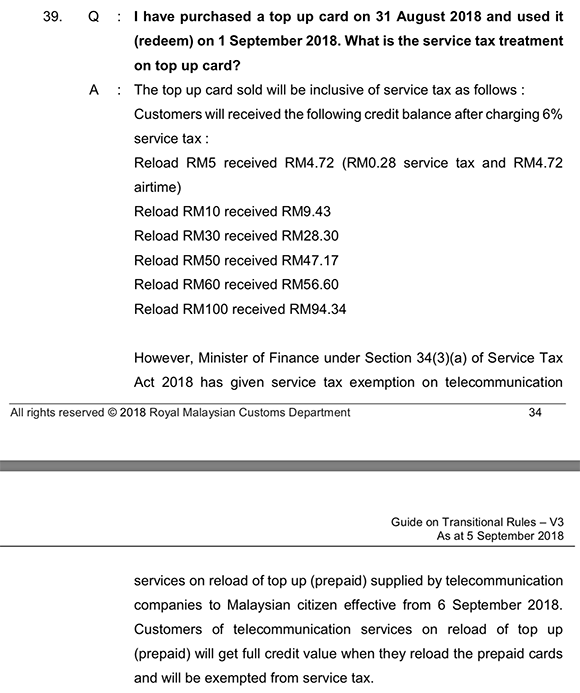

As highlighted earlier, prepaid services are actually subjected to 6% SST. This was documented by the Royal Malaysian Customs Department and all telcos have imposed SST for all prepaid reloads similar to postpaid and broadband services. So basically, telcos were merely following the directive by Customs when it comes to SST implementation.

After several reported outbursts through the media, the Ministry has finally issued a statement that prepaid services provided to Malaysians by telcos must be exempted from SST. The exemption which falls under Section 34(3)(a) of the Service Tax Act 2018 will be enforced starting tomorrow, 6 September 2018. Now it looks like all telcos will need to comply and you should be getting the full value starting midnight tonight.

So far there’s no mention about top ups made between 1-5 September since the exemption is only effective starting tomorrow.

UPDATE: We’ve been informed by a telco that there won’t be a refund as tax collected between 1-5 September goes to be government as part of the SST implementation. Those that have topped up during this period are given freebies in the form of free minutes or data.

UPDATE 2: The Royal Malaysian Customs Department has released a new guide which mentions the service tax treatment on prepaid reload.

This confirms that SST is applicable for top ups made between 1-5 September 2018 and it is exempted for Malaysians starting 6 September 2018 onwards.

As mentioned before, we believe this issue could have been avoided if prepaid was exempted from the start.

What do you think? Let us know in the comments below.