As more digital wallets are being introduced, AirAsia has just introduced BigPay as a way to go truly cashless. According to its group CEO, Tan Sri Tony Fernandes, BigPay is part of their digital strategy and it has the potential to be worth more than AirAsia itself, considering AirAsia has a huge database of over 63 million customers.

Unlike most e-wallets like vcash and FavePay, AirAsia’s BigPay is based on a Mastercard prepaid card that’s managed fully by its BigPay app. Since it works like a normal credit/debit card, users can make payments at over 35 million Mastercard merchants worldwide. If you need cash, you can use the BigPay card for cash withdrawals at any ATM that has a Mastercard logo.

Since this is prepaid, you won’t need to open a bank account. Just order a BigPay card and top it up with sufficient balance before you start spending.

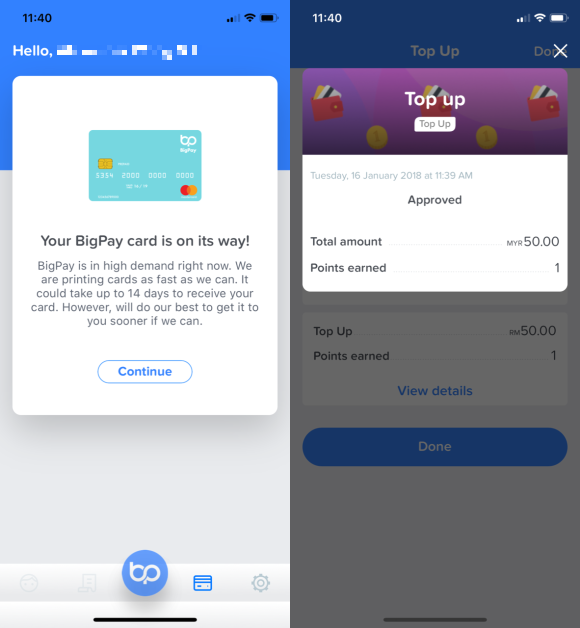

To apply for a BigPay card, you’ll need to install the app and make a top-up of RM50. Unfortunately, you can only use credit/debit card to top up at the moment but they are working to accept more sources including cash, CIMB Clicks, Maybank2u, Paypal and more in the future. During the registration process, you’ll be required to submit a photo of your IC or passport, and a selfie picture of yourself for verification.

Since BigPay is digitally driven, you get full transparency on your card’s activities on the official app including fees and charges. The app will notify you when you make or receive a payment and when your card balance is low.

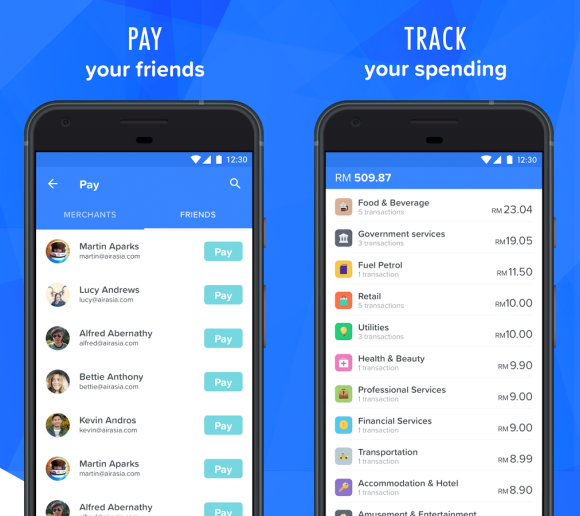

For better tracking, you can even attach a copy of your receipt and view your expenditure by category. The app also allows you to set your prefered PIN and you can block your card immediately if it’s stolen or missing.

Unlike your typical payment cards, BigPay will support peer to peer transfer among contacts that have a BigPay card. This is probably the best way to split bills as you can transfer money without fumbling over small change and there are no fees for card to card transfers.

The card also lets you earn BIG points when you top up or make a purchase. For those who travel a lot of AirAsia, card holders can also enjoy zero processing fee when you book your AirAsia tickets online.

In terms of charges, BigPay will waive all additional fees on domestic and international transactions that are usually charged by other financial institutions. For moments when you need cash, there’s an RM6 charge for domestic and a flat RM10 charge for international withdrawals. If you’re withdrawing overseas, BigPay will waive the typical 2% fee for withdrawals until further notice. Some ATMs might charge additional fees on top of the RM10 charge and this amount will be shown while conducting the withdrawal.

According to its product disclosure sheet, BigPay will charge a monthly service fee of RM2.50 if there’s no transaction in that particular month but this is waived until further notice. Do take note that the BigPay card doesn’t seem to work well with Grab, and they are still trying to resolve the issue.

For now, BigPay is basically a prepaid card that comes with a comprehensive app. In the future, they will be introducing QR-code based payments as well as a multiple currency feature within the app. This is quite similar to AirAsia’s current BIG prepaid and AirAsiaEZpay prepaid card. Both have support for multiple currencies such as USD, GBP, EUR, AUD, SGD and MYR but you can only manage your account through its desktop website.

For more info, you can check out the BigPay website, or you can try it out by installing the Android or iOS app.