The first quarter of 2016 was an exciting one with telcos countering each other with competitive plans. After an intensive telco price war, Maxis had revamped its MaxisONE Plan with more data along with a new way of sharing quota to supplementary lines. On the prepaid front, they have also offered 8GB of free data for weekend use.

So how did this affect Maxis? Read on as we take a closer look at their Q2 2016 results.

According to Maxis CEO, Morten Lundal, the last quarter wasn’t an easy one. Service revenue was slightly lower at RM2.05 billion vs RM2.09 billion during Q2 2015. While postpaid revenue increased marginally from RM927 million to RM975 million, prepaid had a decline from RM1.01 billion to RM959 million when compared during the same period.

In terms of operational profits (EBITDA), Maxis faced a slight decline from RM1.10 billion to RM1.05 billion. Meanwhile profit after tax had seen an increase by 9% from RM443 million in Q2 2015 to RM483 million in Q2 2016.

Subscribers and ARPU

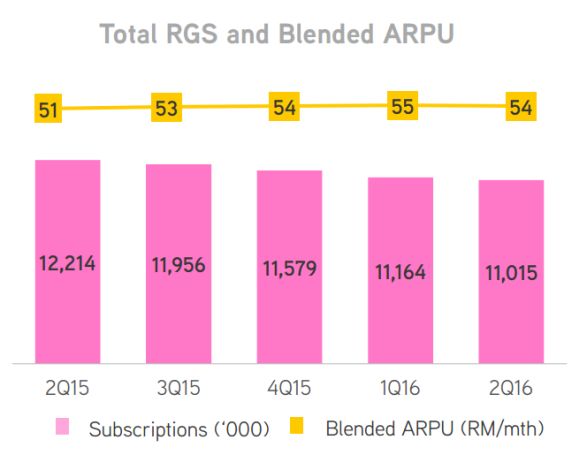

The overall number of subscribers on Maxis is still showing a declining trend with a total of 11.02 million subscribers recorded in the last quarter. As a comparison, Digi appears to be having the largest number of subscribers with 12.3 million users reported in their Q2 2016 report.

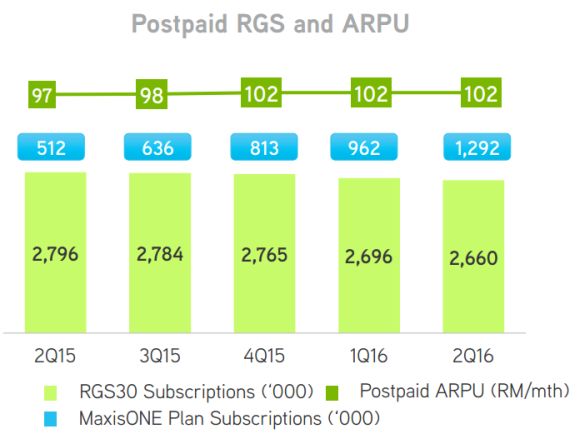

After having their largest postpaid upgrade in April, the green telco had enjoyed a jump in MaxisONE plan subscribers in Q2. They had breached over a million subscribers in April and now they have 1.3 million MaxisONE customers, which is a 30% increase.

Looking at the postpaid segment as a whole, the number of postpaid customers have declined slightly from 2.696 million subscribers in Q1 2016 to 2.660 million in Q2 2016. From this, we can assume that most new MaxisONE subscribers are converted from older postpaid plans such as SurfMore and ValuePlus.

ARPU (Average Revenue per User) for postpaid is still rather solid for three months in a row at RM102/month. For MaxisONE Plan, the ARPU is much higher at RM143/month.

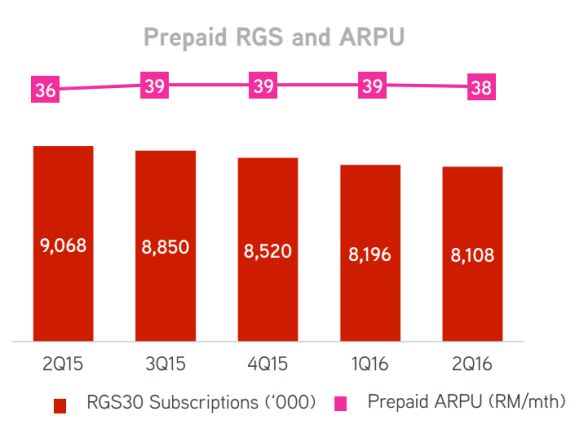

For Hotlink prepaid, subscribers have also reduced slightly from 8.196 million (Q1 2016) to 8.108 million (Q2 2016), while ARPU has dipped slightly from RM39/month to RM38/month.

4G Network

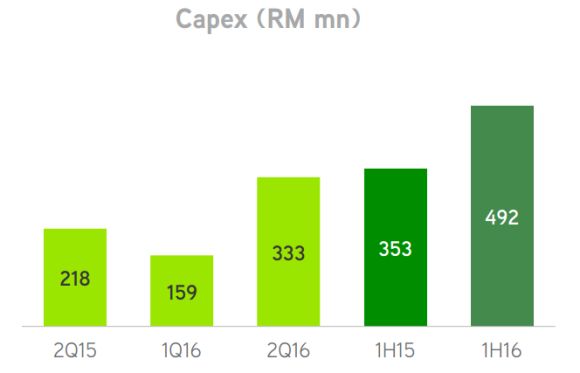

Maxis prides itself in putting huge investments for its 4G LTE network. For Q2 2016, they have invested RM333 million which 52.5% more than the same quarter last year.

They are still claiming the widest 4G LTE population coverage at 87%. At the moment, they cover over 220 cities and towns supported by over 13,000KM of fibre. As comparison, Digi reported 76% population coverage in their Q2 2016 report. The yellow telco’s 4G footprint currently covers 191 major towns and cities supported by 7,000KM of fibre.

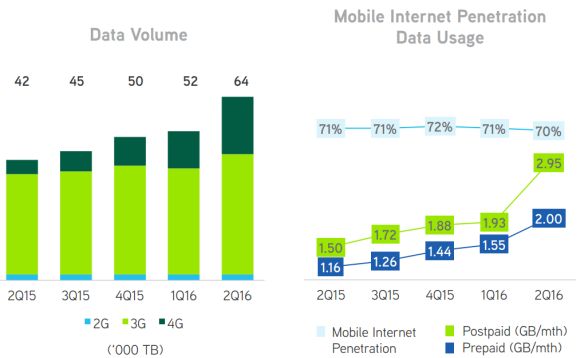

With the increasing number of 4G devices and data quota, Maxis has seen a 50% increase of data usage from an average of 1.7GB in the previous quarter to 2.5GB/month per user. From the chart above, the biggest jump is from postpaid. It is also not surprising that YouTube is the highest data consumption application on their network followed by Facebook and web browsing.

For a quick recap, you can watch the video below or download the full Q2 2016 presentation deck over here.