Android Pay becomes the third contactless mobile payment platform to hit Singapore after Samsung Pay and Apple Pay was launched earlier this year. Still, Singapore is the first country in Asia (and third in the world after US and the UK) to have the payment system.

Android Pay harnesses the built-in NFC in your Android smartphone to make payments at supported merchants. Simply download the application on your NFC-enabled Android KitKat 4.4 and above smartphone, register your card and you would be good to go.

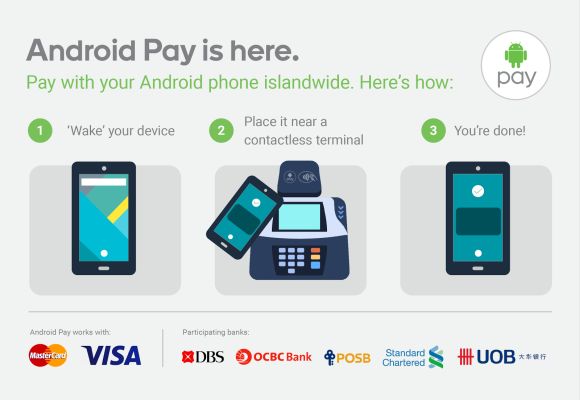

Google’s mobile payment service is available at thousands of merchants islandwide that accepts NFC contactless payment which includes 7-11, BreadTalk, Cold Storage, McDonalds and many more. Simply wake your smartphone and hold it up to the payment terminal and your payment is done.

But, with mobile payment apps like Samsung Pay and Apple Pay already available, how can Google’s Android Pay distinguish itself? Especially since Samsung Pay also works with old school Magnetic Secure Transmission (MST) machines too.

Well, device support, Google claims. Android Pay is available on all Android devices that are NFC-enabled and you can use this service with a simple app download. With Samsung and Apple’s mobile payment solution, you will only be limited to the newer models from each manufacturer.

However, this widespread accessibility also comes at the cost of a secondary level of authentication — the fingerprint reader. With Android Pay, Channel News Asia notes that besides the initial authentication to register your card, all subsequent transactions did not require any authentication at all. On Apple and Samsung, you would be required to authenticate with your fingerprint first.

Of course, Google says that Android Pay has gone through all the key considerations for its design and has also adopted the “industry-standard tokenisation”. Google also says that should you lose your device, you can use the Android Device Manager to lock your device, secure it with a new password or even wipe it clean of your personal information.

Android Pay will work with MasterCard and Visa cards from DBS Bank, OCBC Bank, POSB, Standard Charted Bank and UOB at launch. There is also no limit on the number of cards that can be added by the consumer. Android Pay will also support loyalty schemes that can be added to it so you won’t have to worry about forgetting your loyalty card.

For now, Android Pay does not support payment for public transport around the island or in-app purchases though the search engine giant has noted that it’s interested in the former and coming “later in the year” on apps like Uber, Grab, Zalora, Singapore Airlines, Shopee and Deliveroo for the latter.

According to Channel News Asia (CNA), retailers that are offering support for Android Pay on launch include McDonald’s, NTUC FairPrice, Sheng Siong, Giant and Watsons. McDonald’s is also introducing a promotion for users who pay with Android Pay, the details of which you can read in CNA’s article.

For more information on Android Pay as well as the mobile payment’s support in Singapore, check out Google’s blogpost.