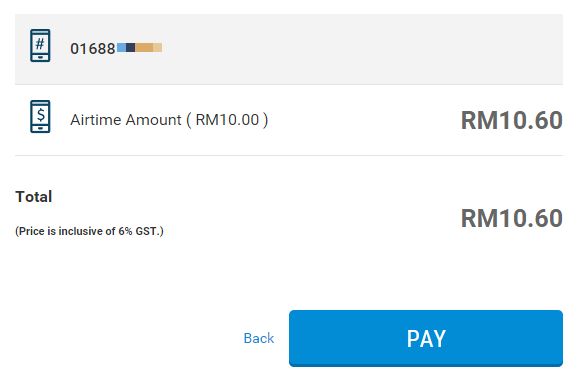

The implementation of GST in Malaysia has caused a stir for prepaid users as there was confusion on the extra 6% tax on top ups/reloads. To make things clear, 6% GST will be applied to all telco services whether it is postpaid or prepaid with the exception of international roaming charges. So if you’re buying a RM10 top up, you have to pay RM10.60 and a RM50 top up would cost you RM53. There’s no running away from it at the moment.

As consumers were caught unaware of the new charges, things got more confusing when Deputy Finance Minister Datuk Haji Ahmad Maslan declared that there shouldn’t be any price increase of prepaid reloads. You can probably imagine the chaos at phone shops and convenience stores nationwide. Even some shops were reported to stop selling prepaid reloads as they had gotten fed up with justifying the added charges.

Prepaid Reloads are subject to GST

With growing number of complaints (815 on the first day), the Communication and Multimedia Consumer Forum of Malaysia (CFM) had came out to clear the air that the 6% GST will indeed be added to the reload price. Below are the main pointers:

1. Reload for prepaid is subjected to GST upon activation.

2. The value of the reload is identical to pre-GST, the only difference is that GST is added to the reload amount.

3. The industry is in compliance with the GST Act 2014, and therefore has added GST to the current value of reload (so for example, RM10 reload value will now cost RM10.60), which is agreeable to Customs since the underlying value of the reload is unchanged.

4. The industry agrees with Customs that many customers feel the burden of GST for some items, including prepaid. Therefore, as a transitional measure, the industry will give to all customers who reload RM5 and above a value which is higher than the GST addition, in forms of free minutes and SMS. For example, customers will get 5 voice minutes and 5 SMS for every top up of RM10. While for reloads of RM20, the customer will receive 10 voice minutes and 10 SMS. This will apply for three months, starting tomorrow, 3 April 2015.

5. The Customs and the industry will continue to work together on the implementation of GST.

Service Tax vs Goods and Services Tax

So what was our Deputy Finance Minister ranting about when GST was clear cut? The answer actually lies on the old Services Tax which was applicable all these while. This is the same as the 6% service tax that’s imposed on our monthly postpaid bills. Datuk Haji Ahmad Maslan explained that there’s no price difference for consumers as GST replaces the Services Tax directly.

What actually happened is that all telcos have been absorbing the 6% services tax. The tax was imposed in accordance to the Service Tax Act 1975 since the beginning of prepaid and they had tried to pass the buck back to consumers in 2011. Unfortunately for them, that didn’t happen as it faced strong opposition from several parties. With the introduction of GST, this was the window of opportunity for telcos to stop absorbing the 6% which they have doing for years.

So what’s next

All prepaid reloads would cost 6% more and all telcos have agreed to give an extra value add such as free voice call minutes and SMS for each top up to cushion the increase cost. However MCMC will be conducting a survey to determine if reloads are better sold at the old price but with GST included. So instead of paying RM10.60 for a RM10 reload, they would be selling a RM10 reload with RM9.43 value after GST. That would also make payments easier as you won’t need to fumble over spare change for the extra 6%.

What do you guys think? Share your thoughts in the comments below.