Dumbphones are on the way out!

Global marketing intelligence firm IDC has just released its latest findings on the current state of world’s mobile phone market and the numbers are very interesting.

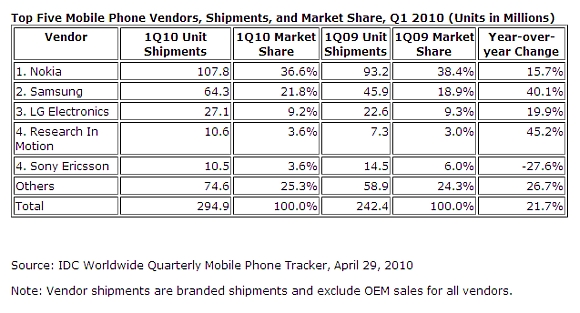

First up, global mobile phone sales have increased to 27.1% in the first quarter of this year – a marked increase from the same quarter last year. Overall, mobile phone makers shipped out 242.9 million devices in the first three months of this year compared to 242.2 units in the first quarter of 2009.

Secondly, IDC says that the strong growth in the sales of mobile phones is fueled by a strong demand for smartphones. This is clearly evident in the fact that for the first time, Blackberry made it into the top 5 devices being shipped in 1Q10. At the same time Motorola, who was once a dominant force in the mobile phone market consistently being ranked in the top 5 of the IDC list, didn’t ship enough devices to make the cut. Motorola ranked as high as number 2 in 2004 and was ranked fifth last year.

For 1Q10 RIM, the makers of Blackberry, pushed 10.6 million units compared to Motorola’s 8.5 million units in the same period.

Apple on the other hand, managed to ship out 8.75 million iPhones in the first three months of 2010. In comparison, Nokia, the world’s number one mobile phone maker, puts out a whopping 107.8 million units in 1Q10; making almost half of the total number of mobile phones shipped in the the quarter.

What does this all mean?

Smartphones are the way of the future. There is a strong demand for converged devices and manufacturers need to pay attention. For us, 2010 will possibly be one of the best years for smartphones ever.

So does this hold true in Malaysia. Will your next mobile phone purchase be a smartphone?

Check out the official numbers right after the jump

Top Five Mobile Phone Vendors

Nokia started the year with a strong first-quarter unit shipment performance, driven by its top-selling 5130 and 2700 models. Shipments of 107.8 million in 1Q10 represented a nearly 16% improvement over the same quarter last year. The overall figures, however, fell short of the first-quarter high it set in 2008. Converged mobile device shipments increased sharply on a year-over-year basis due to top-selling models such as the 5230, 5800, 5530, and X6. However, average selling prices for converged mobile devices dropped to €155 in 1Q10, compared to €186 in the previous quarter. Nokia plans to ship the N8 (the first converged device to run the Symbian 3 operating system) in the third quarter. The N8 will cost €370, according to Nokia, and is expected to boost Nokia’s overall ASP.

Samsung held steady as the number two vendor worldwide for the twelfth consecutive quarter with total shipment volumes greater than those of the next three vendors combined. Driving its results was a combination of new devices launched and expansion of distribution channels within emerging markets. Moreover, efforts to bring high end devices, including touchscreen phones and converged mobile devices, pushed ASPs higher. Samsung plans to launch more Android and bada-powered devices later this year while launching more touch-enabled devices for the mass-market.

LG Electronics remained the number three vendor worldwide with year-over-year shipment growth of nearly 20%, but declining revenue and profit due to seasonality and reduced prices. The abundance of feature phones at varying price points kept the company in good stead with carriers and customers, particularly within emerging markets where LG reaped triple digit growth. Still, the lack of a broad and deep smartphone portfolio made it vulnerable to competitor share gains, particularly within North America. LG plans to introduce several Android, Windows Mobile 6.5, and Windows Phone 7 devices later this year while expanding its global platform to reach new markets.

Research In Motion makes its first appearance among the top five vendors worldwide, with total shipments surpassing those of Motorola by nearly 2 million units. Research In Motion is the only vendor in the top 5 with a singular focus on smartphones, and as a result, the company enjoys the highest average selling prices within that group. Key to its success in the first quarter was the popularity of its BlackBerry Curve 8520 and BlackBerry Bold 9700 across multiple markets as well as its global prepaid offerings. Strong consumer adoption, particularly among text-crazy teens, has also fuelled demand for BlackBerry devices.

Sony Ericsson returned to profitability in the first quarter due to cost cutting and new product introductions. The joint venture launched six new handsets including three new Greenheart models – Aspen, Elm, and Hazel – as well as the Xperia X10 and Vivaz converged devices. Average selling prices rose 12% as Sony Ericsson pruned several less-profitable products from its lineup. However, overall shipments in the first quarter fell 28%. Three new converged devices – the Vivaz pro, Xperia X10 mini, and Xperia X10 mini pro – will ship towards end of the second quarter.