The top 5 list for global smartphone shipments is seeing a little shake up this quarter as Xiaomi has recaptured the #5 spot. They were once a top 5 brand before OPPO and vivo had flooded the market with their selfie-centric devices.

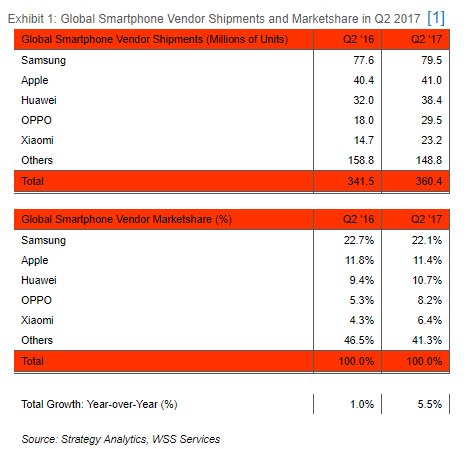

For the past one year, the top 5 is usually dominated by Samsung and Apple, followed by the typical Chinese giants such as Huawei, OPPO and vivo. According to Strategy Analytics’ global smartphone market share report for Q2 2017, Xiaomi has made a comeback by shipping 23.2 million phones in the last quarter, beating vivo from the number 5 spot.

This marks a 58% year on year increase with a global market share of 6.4%. As a comparison, exactly a year ago Xiaomi had shipped 14.7 million phones and had gained a market share of 4.3% for Q2 2016 before they were taken over by vivo. The rise of Xiaomi is attributed to its affordable Redmi series where its entry-level Redmi 4A is said to be a huge hit in India, beating the likes of Lenovo and Micromax.

Holding the top spot is still Samsung with 79.5 million units shipped while Apple maintains its #2 spot with a shipment of 41.0 million iPhones. Xiaomi’s other home ground rivals are still holding on pretty well with significant increase year on year. Huawei has shipped 38.4 million phones which mark a 20% increase and a strong 10.7% market share. Meanwhile, OPPO has grown by 64%, shipping 29.5 million units with a global market share of 8.2%.

Over in Malaysia, we can see that Xiaomi is becoming more accessible as it has expanded its sales channel via Lazada and authorised resellers. With this arrangement, it seems that Xiaomi is able to bring its newer models faster than before. For example, the Mi Max 2 which was announced in May is now available for pre-order in Malaysia. In order for Xiaomi to keep up with the momentum, they would need to produce more compelling and affordable smartphones to keep up with demand.

UPDATE: IDC has also published its Q2 2017 report with Xiaomi clinching the #5 spot.

According to IDC, Xiaomi has increased by 58.9% year over year and they have been aggressive in increasing its offline presence in India. This was contributed by the opening of their Mi Home store and partnering with key retailers to increase its retail footprint.

What do you guys think? Leave your thoughts in the comments below.