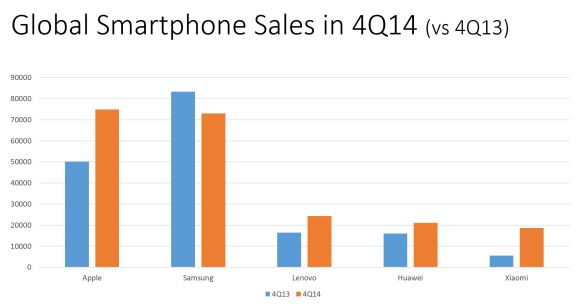

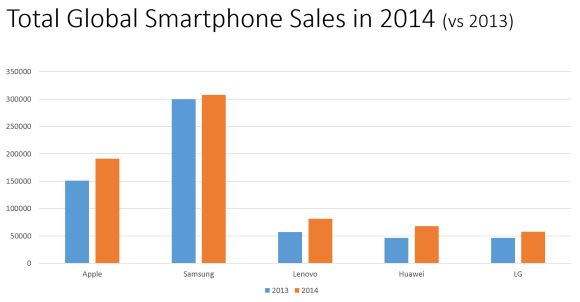

Apple sold more smartphones than Samsung in the last quarter of 2014 and no wonder the Korean brand is worried, because the Korean brand has been selling more phones than Apple since 2011. But the blue oval of tech still commands a large chunk of the smartphone market share (24.7% in 2014 over Apple’s 15.4%), according to Gartner.

However, Apple is not the only problem Samsung has in his hands. On the other end of the spectrum, you have Xiaomi, Huawei, Lenovo and Oppo, these Chinese brands are quickly winning customers over in the middle and lower end of the market segment — a segment that used to be a Samsung stronghold. If the trend continues, Samsung will have a major problem in its hands.

“Samsung’s performance in the smartphone market deteriorated further in the fourth quarter of 2014, when it lost nearly 10 percentage points in market share,” said Anshul Gupta, principal research analyst at Gartner. “Samsung continues to struggle to control its falling smartphone share, which was at its highest in the third quarter of 2013. This downward trend shows that Samsung’s share of profitable premium smartphone users has come under significant pressure.”

This makes the Galaxy S6 and S6 Edge the most important devices Samsung has ever produced. Announced at Mobile World Congress 2015, the Galaxy S6 and S6 Edge will have to turn Samsung’s fortunes around and putting the brand back on top over arch rivals, Apple.

Meanwhile, the smartphone pie continues to grow. Worldwide smartphone sales continue to grow at record pace. Last year, smartphones sales totaled a whopping 1.2 billion units, up 28.4% from 2013 and smartphone sales represented two-thirds of global mobile phone sales.

Apple reported its best quarter ever in the fourth quarter of 2014, which saw it sell 74.8 million units and move to the No. 1 position in the global smartphone market. The iPhone 6 and iPhone 6 Plus continued to see huge demand with sales in China and U.S., growing at 56% and 88%, respectively.

In the best of the rest category, Lenovo with its acquisition of Motorola complete, rose to the No. 3 spot in the global smartphone market, commanding a 6.6% global market share and growing a massive 47.6% growth year over year. Driving Lenovo’s strong growth is China, Russia, India, Indonesia and Brazil.

Chinese vendors, such as Huawei and Xiaomi, are continuing to improve their sales in China and other overseas markets, increasing their share in the mid to low-end smartphone market. “Chinese vendors are no longer followers,” said Ms. Cozza. “They are producing higher quality devices with appealing new hardware features that can rival the more established players in the mobile phone market. Brand building and marketing will be key activities in deciding which Chinese vendors can secure a foothold in mature markets.”

2015 is shaping up to be an interesting year. As competition ramps up, consumers can expect smartphones to continue to improve as brands innovate to further different themselves from competitors giving you more choices at more affordable and attractive prices.